| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☑ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

| ☑ | No fee required. |

| ☐ |

| ||

| ||

| ||

| ||

| ||

| Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| A Letter from the CEO |  |

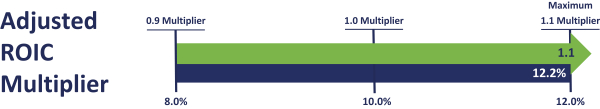

Juan R. Luciano B O A R D C H A I R A N D C E O | Dear Stockholders, ADM’s 2023 performance continued to demonstrate the strength of In 2023, we delivered adjusted earnings per share of $6.98 and trailing 4Q average adjusted return on invested capital of 12.2%, all while returning $3.7 billion to shareholders via dividends and share repurchases. Throughout the year, our 42,000 colleagues around the globe continued to advance strategic initiatives that are serving our customers’ evolving needs, from launching regenerative agriculture in South America and Europe, to commissioning our joint venture oilseed facility in North Dakota, to expanding our starch capacity to serve customer needs across food and industrial products. We also continue to drive a path to decarbonization that not only accelerates ADM’s Strive 35 efforts, but also supports our customers’ growing need for low-carbon solutions. Now, as we advance through 2024, we are focused on continuing to build a stronger ADM for the future, executing strategic initiatives that provide strong growth prospects while remaining firmly committed to our productivity efforts to drive efficiencies, cost savings and cash generation. Safety is core to ADM’s culture, but our track record for continuous progress suffered a setback in 2023. We remain committed to safety as our highest priority, and we are taking an array of aggressive actions to make sure our future performance returns to the positive trajectory we’ve seen in the past. Part of building a better ADM is ensuring we take every measure to improve performance where needed, including simplification and optimization within our Nutrition business and a continued strong focus on our manufacturing footprint to ensure we are meeting customer needs effectively, efficiently, and, most of all, safely. Our purpose – to unlock the power of nature to enrich the quality of life – continues to drive our work and our path forward, and I know that ADM will continue to play its Sincerely yours,

Juan R. Luciano Board Chair, CEO and President | |||

“We are focused on continuing to build a stronger ADM for the future.” Juan Luciano | ||||

| 2023 in Review |  |

Creating Value

for Customers and Shareholders

dividend by 11%; 51 consecutive years of dividend increases | ||||

shareholders via dividends & share repurchases | Announced up to $2B in additional share repurchases, including $1B in accelerated share repurchase program | |||

Green Bison soybean facility | ||||

regenerative agriculture initiatives globally | Completed Marshall starch expansion | |||

The Letter and Financial Highlights above refer to non-GAAP, or “adjusted,” financial measures that exclude certain items from the comparable GAAP measure. For a reconciliation of these non-GAAP items to GAAP, please refer to Annex A to our proxy statement.

| A Letter from the Lead Director |  |

Terrell K. Crews L E A D D I R E C T O R | Dear Shareholders, Serving as your Lead Independent Director is a great privilege, made possible by the trust you have instilled in the Board as stewards of your capital and of our company. My fellow directors and I recognize the important responsibility we have to you, and we appreciate your investment and belief in ADM as we continue working on your behalf. Continued Financial Execution I’m pleased to report that despite a volatile market environment, ADM delivered strong results in 2023, speaking to the resilience of ADM’s business and its unparalleled global footprint and capabilities. To support our value creation efforts, the Board, in close coordination with management, remains laser-focused on our 2024 strategic priorities of driving operational excellence across all segments, executing cost discipline and maintaining the highest standards of ethics and safety. Strong Corporate Governance ADM is governed by a highly engaged and diverse group of directors with deep expertise in and experience across areas critical to the company’s operation. Core to our success as a Board is our ability to effectively chart the overall trajectory of the company. We have added four new directors to the Board over the last five-year period to ensure we have the right mix of skills, experience and new perspectives to guide the company forward. Throughout 2023, we regularly engaged with management on critical areas such as strategic investments, returning value to shareholders, capital allocation, succession planning, safety and compliance. We are acutely aware of our responsibility as an independent governing body and remain committed to driving shareholder value with integrity and transparency. Earlier this year, ADM’s Board acted decisively and transparently while conducting its Audit Committee-led investigation. Strong leadership practices and true director independence are important stalwarts of good governance. We take this responsibility seriously and are committed to demonstrating leadership and accountability in all aspects of our role. Looking Ahead We are grateful for our engagement meetings with shareholders, which always provide valuable feedback that continues to inform our Board priorities and governance practices. Looking ahead, we remain confident that ADM is well positioned to deliver long-term value for our shareholders, customers and employees. Thank you for your investment and continued support. Sincerely yours,

Terrell K. Crews Lead Director | |||

ARCHER-DANIELS-MIDLAND COMPANY

77 West Wacker Drive, Suite 4600, Chicago, Illinois 60601

Notice of Annual Meeting

NOTICE OF ANNUAL MEETING

To All Stockholders:

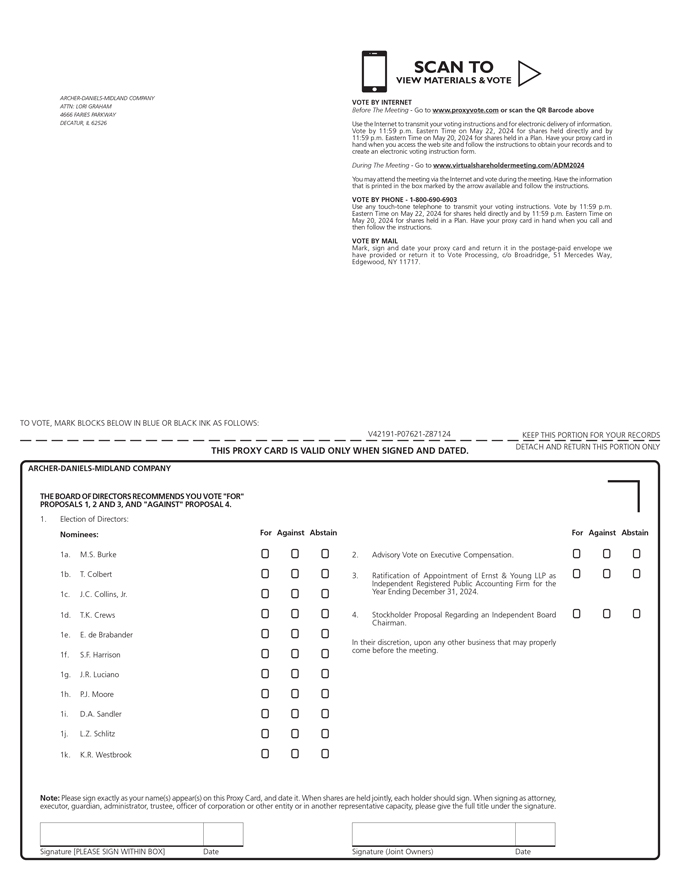

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Archer-Daniels-Midland Company, a Delaware corporation, will be held at the JAMES R. RANDALL RESEARCH CENTER located at 1001 Brush College Road, Decatur, Illinois, on Thursday, May 3, 2018,23, 2024, commencing at 8:3000 A.M., for Central Daylight Time. The annual meeting will be a completely virtual meeting of stockholders. You may attend the following purposes:online meeting, submit questions, and vote your shares electronically during the meeting via the internet by visiting www.virtualshareholdermeeting.com/ADM2024. To enter the annual meeting, you will need the 16-digit control number that is printed on your Notice of Internet Availability of Proxy Materials. We recommend that you log in at least 15 minutes before the meeting to ensure that you are logged in when the meeting starts. Online check-in will start shortly before the meeting on May 23, 2024.

(1) To elect directors

| Date and Time | Location | Record Date | ||||||

|  |  | ||||||

Thursday, May 23, 2024 8:00AM CDT | Virtual Meeting www.virtualshareholdermeeting.com/ADM2024 | Thursday, April 4, 2024 | ||||||

Items to hold office untilBe Voted On

At the next Annual Meeting of Stockholdersannual meeting, you will be asked to consider and until their successors are duly elected and qualified;

(2) To ratify the appointment by the Board of Directors of Ernst & Young LLP as independent auditors to audit the accounts of our company for the fiscal year ending December 31, 2018;

(3) To consider an advisory vote on the compensation of our named executive officers;

(4) To approve the material terms of the ADM Employee Stock Purchase Plan;

(5) To consider and act upon the stockholder’s proposal regarding an independent board chairman set forth in the accompanying proxy statement; and

(6) To transact such other business as may properly come before the meeting.following matters:

ITEM | PAGE REFERENCE | VOTING RECOMMENDATION | |||||||||||

1. |

8 |

FOR | |||||||||||

2. | To consider an advisory vote on the compensation of our named executive officers; | 33 | FOR | ||||||||||

3. |

78 |

FOR | |||||||||||

4. | To consider and act upon a stockholder proposal regarding an independent board chairman; and |

82 |

AGAINST | ||||||||||

5. | To transact such other business as may properly come before the meeting. | ||||||||||||

How to Vote

| Internet | Call | Virtual Meeting | ||||||||||||||||||||||||||||

| Vote using your smartphone or computer | Call the toll-free number listed on the proxy card | Complete, sign and return your proxy card | Vote online during the meeting |

By Order of the Board of Directors |

|

REGINA B. JONES, CORPORATE SECRETARY April 10, 2024 |

March 23, 2018

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON MAY REPORT

|

| We encourage our shareholders to enroll in voluntary e-delivery for future proxy materials. Electronic delivery is convenient and provides immediate access to these materials. This will help us save printing and mailing expenses and reduce our impact on the environment. Follow the simple instructions at www.proxyvote.com. |

Table of Contents

PROXY SUMMARYThis proxy statement contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 that involve substantial risks and uncertainties. All statements, other than statements of historical fact included in this proxy statement, are forward-looking statements. These statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “plan,” “intend,” “believe,” “may,” “outlook,” “will,” “should,” “can have,” “likely,” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. For example, all statements the Company makes relating to its future results and operations, growth opportunities, pending litigation and investigations, and timing of the remediation of the Company’s material weakness in the Company’s internal control over financial reporting are forward-looking statements. All forward-looking statements are subject to significant risks, uncertainties, and changes in circumstances that could cause actual results and outcomes to differ materially from the forward-looking statements. These forward-looking statements are not guarantees of future performance and involve risks, assumptions, and uncertainties, including, without limitation, those that are described in Item 1A, “Risk Factors” included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, as may be updated in subsequent Quarterly Reports on Form 10-Q. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual outcomes may vary materially from those indicated or anticipated by such forward-looking statements. Accordingly, you are cautioned not to place undue reliance on these forward-looking statements. Except to the extent required by law, Archer-Daniels-Midland Company does not undertake, and expressly disclaims, any duty or obligation to update publicly any forward-looking statement whether as a result of new information, future events, changes in assumptions, or otherwise.

Proxy Summary

The following is a summary of certain key disclosures in this proxy statement. This is only a summary, and it may not contain all of the information that is important to you. For more complete information, please review this proxy statement in its entirety as well as our 20172023 Annual Report on Form10-K. As used in this proxy statement, “ADM” or the “Company” refers to Archer-Daniels-Midland Company. The information contained on adm.com or any other website referred to in this proxy statement is provided for reference only and is not incorporated by reference into this proxy statement.

General Information

ANNUAL MEETING OF STOCKHOLDERS

| Date and Time | Location | Record Date | ||||||

|  |  | ||||||

Thursday, May 23, 2024 8:00AM CDT | Virtual Meeting www.virtualshareholdermeeting.com/ADM2024 | Thursday, April 4, 2024 | ||||||

General Information

See pages 4–5

Meeting: Annual Meeting of Stockholders

Date:Thursday, May 3, 2018

Time: 8:30 A.M.

Location: JAMES R. RANDALL RESEARCH CENTER,

1001 Brush College Road, Decatur, Illinois

Record Date: March 12, 2018

Stock Symbol: ADM

Exchange: NYSE

Common Stock Outstanding: 558,872,570 501,763,545 as of March 12, 2018April 4, 2024

Registrar & Transfer Agent: Hickory Point Bank and Trust, fsb

State of Incorporation: Delaware

Corporate Headquarters and Principal Executive Office:

77 West Wacker Drive, Suite 4600, Chicago, Illinois 60601

Corporate Website: www.adm.com

ITEMS TO BE VOTED ON | PAGE REFERENCE | VOTING RECOMMENDATION | |||||||||||

1. | 8 | FOR | |||||||||||

2. | 33 | FOR | |||||||||||

3. | Ratification of Appointment of Independent Registered Public Accounting Firm (Ernst & Young LLP) | 78

|

FOR | ||||||||||

4. | 82 | AGAINST | |||||||||||

Meet the Nominees

|  |  |  |  |  | |||||

| Michael S. Burke | Theodore Colbert | James C. Collins, Jr. | Terrell K. Crews | Ellen de Brabander | Suzan F. Harrison | |||||

|  |  |  |  | ||||

| Juan R. Luciano | Patrick J. Moore | Debra A. Sandler | Lei Z. Schlitz | Kelvin R. Westbrook | ||||

| ADM Proxy Statement 2024 | 1 |

| PROXY SUMMARY — Governance Highlights |

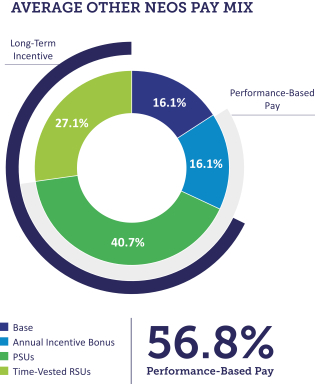

Executive Compensation

See pages 37–47

CEO: Juan R. Luciano

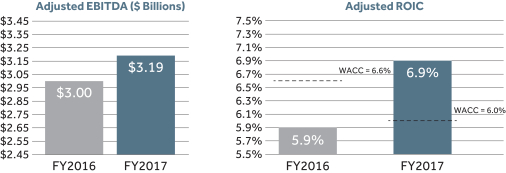

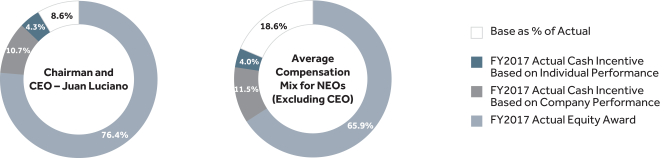

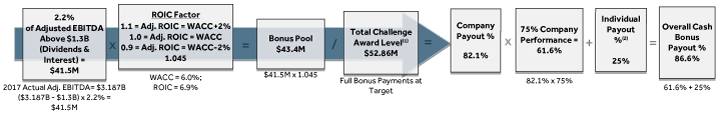

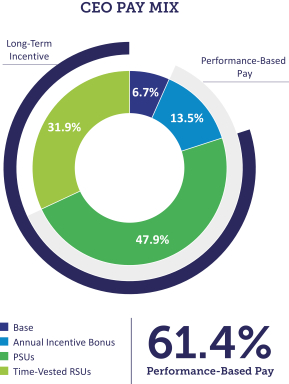

CEO 2017 TOTAL DIRECT COMPENSATION:

• Salary: $1,300,008

•Non-Equity Incentive Plan Compensation: $12,166,416

• Long-Term Incentives: $2,251,600

CEO Employment Agreement: No

Change-in-Control Agreement: No

Stock Ownership Guidelines: Yes

Hedging Policy: Yes

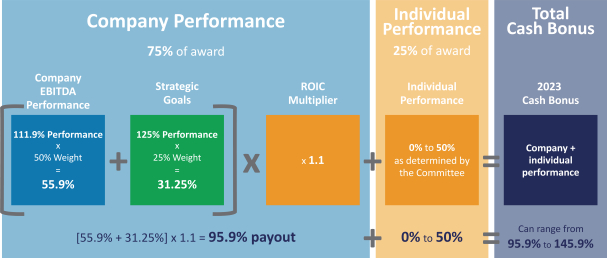

CEO: Juan R. Luciano CEO 2023 Total Direct Compensation: • Salary: $1,482,918 • Non-Equity Incentive Plan Compensation: $3,609,611 • Long-Term Incentives: $17,919,686 CEO Employment Agreement: No Change in Control Agreement: No Stock Ownership Guidelines: Yes Anti-Hedging Policy: Yes | Compensation Highlights | |||

Modest base salary changes for most NEOs: NEO salaries were increased 2% to 4% | ||||

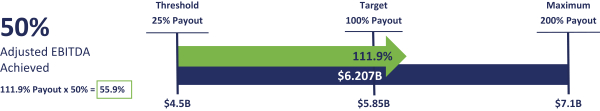

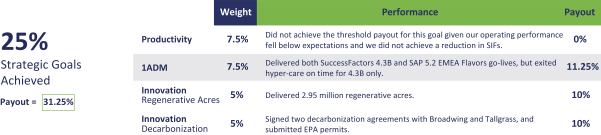

Earned incentives for NEOs on strong company performance: Earned annual incentive between 95.9% and 120.9% of target | ||||

Earned LTI for long-term results: Earned awards were 100% of target | ||||

Corporate Governance

Other Items to Be Voted OnDirector Nominees:11

See pages 53–60

Ratification of Appointment of Independent Registered Public Accounting Firm (Ernst & Young LLP)

Advisory Vote on Executive Compensation

Approval of the ADM Employee Stock Purchase Plan

Consideration and Action Upon the Stockholder’s Proposal Regarding Independent Board Chairman

| • | Michael S. Burke (Independent) |

| • | Theodore Colbert (Independent) |

| • | James C. Collins, Jr. (Independent) |

| • | Terrell K. Crews (Independent) |

| • | Ellen de Brabander (Independent) |

| • | Suzan F. Harrison (Independent) |

| • | Juan R. Luciano |

| • | Patrick J. Moore (Independent) |

| • | Debra A. Sandler (Independent) |

| • | Lei Z. Schlitz (Independent) |

| • | Kelvin R. Westbrook (Independent) |

Corporate Governance

See pages 11–19

Director Nominees: 12

• Alan L. Boeckmann (Independent)

• Michael S. Burke (Independent)

• Terrell K. Crews (Independent)

• Pierre Dufour (Independent)

• Donald E. Felsinger (Independent)

• Suzan F. Harrison (Independent)

• Juan R. Luciano

• Patrick J. Moore (Independent)

• Francisco J. Sanchez (Independent)

• Debra A. Sandler (Independent)

• Daniel T. Shih (Independent)

• Kelvin R. Westbrook (Independent)

Director Term: One year

Director Election Standard: Majority voting standard for uncontested elections

Board Meetings in 2017: 102023: 7

Standing Board Committees (MeetingsCommittee Meetings in 2017):2023:

| • | Audit – 9 |

| • | Compensation and Succession – 4 |

| • | Nominating and Corporate Governance – 4 |

| • | Sustainability and Corporate Responsibility – 4 |

• Audit (9)

• Compensation/Succession (4)

• Nominating/Corporate Governance (4)

Supermajority Voting Requirements: No

Stockholder Rights Plan: No

Governance Highlights

PROXY SUMMARY

GOVERNANCE HIGHLIGHTS

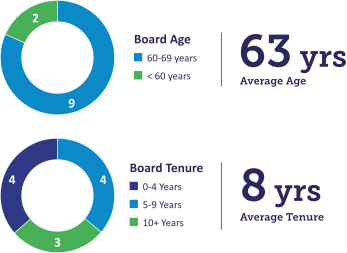

OurThe Board of Directors views itselfplays a critical role as the long-term stewards of ADM. The Board is committed to enhancing the success and value of our companyCompany for its stockholders, as well as for other stakeholders such as employees, business partners, and others.communities. The Board recognizes the importance of good corporate governance and understands that transparent disclosure of its governance practices helps stockholders assess the quality of our companyCompany and its management and the value of their investment decisions.

ADM’s corporate governance practices are intended to ensure independence, transparency, management accountability, effective decision making, and appropriate monitoring of compliance and performance. We believe that these strong corporate governance practices, together with our enduring corporate values and ethics, are critical to providing lasting value to the stockholders of our company.Company.

We use majority voting for uncontested director elections and plurality voting for contested director elections. | 10 of 11 of our | ||

We have an independent Lead Director, selected by the independent directors. The Lead Director provides the Board with independent leadership, facilitates the Board’s independence from management, and has broad powers as described on page | Our independent directors meet in executive session at each regular | ||

We have | Significant stock ownership requirements are in place for directors and executive officers. | ||

The Board and each standing committee annually conduct evaluations of their performance. Directors annually evaluate each other, and these evaluations are used to assess futurere-nominations to | Individuals cannot stand for election as a director once they reach age 75, and our Corporate Governance Guidelines set | ||

Holders of 10% or more of our common stock have the ability to call a special meeting of stockholders. | Our bylaws include a | ||

Our Sustainability and Corporate Responsibility Committee provides Board-level oversight of environmental, corporate social responsibility, diversity, safety, and sustainability matters. | We have been named as one of the “World’s Most Ethical Companies” by Ethisphere for five years running. | ||

DIRECTOR NOMINEE QUALIFICATIONS AND EXPERIENCE

| 2 | ADM Proxy Statement 2024 |

| PROXY SUMMARY — Voting Matters and Board Recommendations |

Voting Matters and Board Recommendations

Proposal | Board Voting Recommendation | Page Reference | ||||||||

Proposal No. 1—Election of Directors for a One-Year Term | FOR | 8 | ||||||||

Proposal No. 2—Advisory Vote on Executive Compensation | FOR | 33 | ||||||||

Proposal No. 3—Ratification of Appointment of Independent Registered Public Accounting Firm (Ernst & Young LLP) | FOR | 78 | ||||||||

Proposal No. 4—Stockholder Proposal – Independent Board Chairman | AGAINST | 82 | ||||||||

| ADM Proxy Statement 2024 | 3 |

| PROXY SUMMARY — Director Nominee Qualifications, Skills, and Experience |

Director Nominee Qualifications, Skills, and Experience

The following chart provides summary information about each of our director nominees’ qualifications, skills, and experiences.experience. More detailed information is provided in each director nominee’s biography beginning on page 7.9.

|  |  |  |  |  |  |  |  |  |  | |||||||||||||||||||||||||||||||||||||||||||||||

CEO Leadership CEO experience at a large public company. | · | · | · | · | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Finance / Accounting Experience in positions requiring financial knowledge and analysis or overseeing internal controls and reporting of public company financial and operating results, including as chief financial officer and/or in accounting, corporate finance, or treasury functions. | · | · | · | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

International Business Experience working outside the U.S. or overseeing a global business. | · | · | · | · | · | · | · | · | · | ||||||||||||||||||||||||||||||||||||||||||||||||

Agriculture / Food / Retail Consumer Experience in agriculture, food, or retail consumer businesses or industries. | · | · | · | · | · | · | · | ||||||||||||||||||||||||||||||||||||||||||||||||||

M&A Experience implementing growth strategies, establishing partnerships, identifying opportunities, and analyzing cultural and strategic fit in connection with mergers, acquisitions, divestitures, and other strategic transactions. | · | · | · | · | · | · | · | · | · | · | |||||||||||||||||||||||||||||||||||||||||||||||

Risk Management Experience assessing and reviewing material risk exposures and the measures to manage and mitigate material risks, including in the areas of operations, health and safety, climate change, cybersecurity, and regulatory. | · | · | · | · | · | · | · | ||||||||||||||||||||||||||||||||||||||||||||||||||

Sustainability / Environmental / Social Experience overseeing environmental impact, corporate social responsibility, or sustainability strategies or initiatives. | · | · | · | · | · | · | · | · | · | ||||||||||||||||||||||||||||||||||||||||||||||||

Sales / Marketing Experience involving branding, marketing, and sales at a global scale and in key markets. | · | · | · | · | · | · | |||||||||||||||||||||||||||||||||||||||||||||||||||

Project Management Experience overseeing or managing large or complex projects, including in the areas of manufacturing, supply chain, logistics, engineering, construction, and M&A integration. | · | · | · | · | · | · | · | ||||||||||||||||||||||||||||||||||||||||||||||||||

Food Science / R&D Experience in scientific or research roles, particularly in agricultural or food science. | · | · | · | · | · | · | |||||||||||||||||||||||||||||||||||||||||||||||||||

Information Technology / Cybersecurity Experience in positions requiring information technology knowledge or overseeing information technology functions, including data management and cybersecurity. | · | · | · | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

Four of our director nominees (Messrs. Crews, Moore, and Westbrook and Ms. Harrison) have earned recognition as part of the NACD Directorship 100™ from the National Association of Corporate Directors (NACD), a leading independent not-for-profit organization dedicated to enhancing corporate governance to drive economic opportunity and positive change in business and the communities they serve. The annual NACD Directorship 100™ celebrates and recognizes the most influential directors and leaders in the corporate governance community who have demonstrated excellence in the boardroom through innovation, courage, and integrity.

| 4 | ADM Proxy Statement 2024 |

| PROXY SUMMARY — Director Nominee Diversity, Age, Tenure, and Independence |

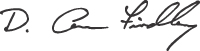

Director Nominee Diversity, Age, Tenure, and Independence

The following charts provide information about our director nominees’ personal characteristics, including race/ethnicity, gender, and age, as well as tenure and independence, to illustrate the diversity of perspectives of our director nominees. More detailed information is provided in each director nominee’s biography beginning on page 9.

| Director Since | Age | Gender | Hispanic/Latinx | Asian | Black or African American | White | ||||||||||||||||||||||||||||||||

M. S. Burke | 2018 | 61 | M |

|

|

|

|

|

|

|

|

| · | |||||||||||||||||||||||||

T. Colbert | 2021 | 50 | M |

|

|

|

|

|

| · |

|

|

| |||||||||||||||||||||||||

J. C. Collins, Jr. | 2022 | 61 | M |

|

|

|

|

|

|

|

|

| · | |||||||||||||||||||||||||

T. K. Crews | 2011 | 68 | M |

|

|

|

|

|

|

|

|

| · | |||||||||||||||||||||||||

E. de Brabander | 2023 | 61 | F |

|

|

|

|

|

|

|

|

| · | |||||||||||||||||||||||||

S. F. Harrison | 2017 | 66 | F |

|

|

|

|

|

|

|

|

| · | |||||||||||||||||||||||||

J. R. Luciano | 2014 | 62 | M | · |

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

P. J. Moore | 2003 | 69 | M |

|

|

|

|

|

|

|

|

| · | |||||||||||||||||||||||||

D. A. Sandler | 2016 | 64 | F | · |

|

|

| · |

|

|

| |||||||||||||||||||||||||||

L. Z. Schlitz | 2019 | 57 | F |

|

|

| · |

|

|

|

|

|

| |||||||||||||||||||||||||

K. R. Westbrook | 2003 | 68 | M |

|

|

|

|

|

| · |

|

|

| |||||||||||||||||||||||||

| ||||||||||||||

|

| |||||||||||||

| ||||||||||||||

|

|

| ||||||||||||

| ||||||||||||||

Black, Asian, or Hispanic | 36% Female | |||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

|

| ADM Proxy Statement |

PROXY SUMMARYGeneral Information About the Annual Meeting and Voting

VOTING MATTERS AND BOARD RECOMMENDATIONS

| ||||

| ||||

| ||||

| ||||

|

GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTINGWhy did I receive this proxy statement?

PROXY STATEMENT

General Matters

OurThe Board of Directors asks that you complete the accompanyingvote by proxy forin advance of the annual stockholders’ meeting. This proxy statement describes the proposals on which you, as a stockholder of the Company, are being asked to vote. It gives you information on the proposals, as well as other information, so that you can make an informed decision. You are invited to attend the annual meeting to vote on the proposals, but you do not need to attend in order to vote. The meeting will be completely virtual and will be held at the time place, and locationweb address mentioned in the Notice of Annual Meeting included in these materials. This year, we will be

Why did I receive a Notice of Internet Availability?

We are using the “Notice“notice and Access”access” method of providing proxy materials to stockholders via the internet. We will mail to our stockholders (other than those described below) a Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy statement and the 20172023 Annual Report onForm 10-K and how to vote electronically via the internet. This notice will also contain instructions on how to request a paper copy of the proxy materials. ThoseStockholders holding shares through the ADM 401(k) and Employee Stock Ownership Plan for Salaried Employees (the “401(k) and ESOP”) and those stockholders who previously have opted out of participation in notice and access procedures will receive a paper copy of the proxy materials by mail or an electronic copy of the proxy materials by email. We are first providing our stockholders with notice and access to, or first mailing or emailing, this proxy statement and a proxy form around March 23, 2018.April 10, 2024.

We payWho is entitled to vote at the costsAnnual Meeting?

Our common stockholders of soliciting proxies from our stockholders. We have retained Georgeson LLCrecord at the close of business on April 4, 2024, are the only holders entitled to help us solicit proxies. We will pay Georgeson LLCnotice of the annual meeting and to vote at the meeting. At the close of business on April 4, 2024, we had 501,763,545 outstanding shares of common stock, each share being entitled to one vote on each of the director nominees and on each of the other matters to be voted on at the meeting.

How do I vote my shares and what can I do if I change my mind after I vote my shares?

If you are a base shareholderstockholder of record, you may vote your shares electronically during the annual meeting services fee of approximately $24,000 plus reasonable project management fees and expenses for its services. Our employees or employees of Georgeson LLC may also solicit proxies in person or by telephone, mail, orvia the internet atby visiting www.virtualshareholdermeeting.com/ADM2024, or you may vote by proxy prior to the annual meeting (1) via the internet by following the instructions provided in the Notice of Internet Availability of Proxy Materials or proxy card, (2) if you received printed proxy materials, by calling the toll free number found on the proxy card, or (3) if you received printed proxy materials, by filling out the proxy card and returning it in the envelope provided. If you are a cost which we expectbeneficial owner of shares held in street name, you must obtain a “legal proxy” from the organization that is the record holder of your shares in order to vote your shares electronically during the annual meeting. You may vote by proxy prior to the annual meeting by following the instructions you receive from the organization that is the record holder of your shares.

If you properly submit a proxy, your shares will be nominal. We will reimburse brokerage firms and other securities custodians for their reasonable fees and expenses in forwardingvoted at the meeting. You may revoke your proxy materialsat any time prior to their principals.voting by:

| (1) | delivering written notice of revocation to our Corporate Secretary; |

| (2) | delivering to our Corporate Secretary a new proxy form bearing a date later than your previous proxy; or |

| (3) | attending the annual meeting online and voting again (attendance at the meeting will not, by itself, revoke a proxy). |

Is my vote confidential?

We have a policy of keeping confidential all proxies, ballots, and voting tabulations that identify individual stockholders. Such documents are available for examination only by the inspectors of election, our transfer agent, and certain employees associated with processing proxy cards and tabulating the vote. We will not disclose any stockholder’s vote except in a contested proxy solicitation or as may be necessary to meet legal requirements.

Our common stockholders of record atWhat is the close of business on March 12, 2018, arequorum required for the only people entitled to noticeannual meeting?

The presence in person or by proxy of the annual meeting andholders of a majority in voting power of the outstanding shares of our common stock entitled to vote at the meeting. At the close ofmeeting will constitute a quorum to conduct business on March 12, 2018, we had558,872,570 outstanding shares of common stock, each share being entitled to one vote on each of the director nominees and on each of the other matters to be voted on at the meeting. Our stockholders and advisors to our company are the only people entitled to attend the annual meeting. We reserve the right to direct stockholder representatives with the proper documentation to an alternative room to observe the meeting.

All stockholders will need a form of photo identification to attend the annual meeting. If you are a stockholder of record and plan to attend, please detach the admission ticket from the top of your proxy card and bring it with you to the meeting. The number of people we will admit to the meeting will be determined by how the shares are registered, as indicated on the admission ticket. If you are a stockholder whose shares are held by a broker, bank, or other nominee, please request an admission ticket by writing to our office at Archer-Daniels-Midland Company, Investor Relations, 4666 Faries Parkway, Decatur, Illinois 62526-5666. Your letter to our office must include evidence of your stock ownership. You can obtain evidence of ownership from your broker, bank, or nominee. The number of tickets that we send will be determined by the manner in which shares are registered. If your request is received by April 19, 2018, an admission ticket will be mailed to you. Entities such as a corporation or limited liability company that are stockholders may send one representative to the annual meeting, and the representative should have apre-existing relationship with the entity represented. All other admission tickets can be obtained at the registration table located at the James R. Randall Research Center lobby beginning at 7:30 A.M. on the day of the meeting. Stockholders who do notpre-register will be admitted to the meeting only upon verification of stock ownership.

The use of cameras, video or audio recorders, or other recording devices in the James R. Randall Research Center is prohibited. The display of posters, signs, banners, or any other type of signage by any stockholder in the James R. Randall Research Center is also prohibited. Firearms are also prohibited in the James R. Randall Research Center.

Any request to deviate from the admittance guidelines described above must be in writing, addressed to our office at Archer-Daniels-Midland Company, Attention: Secretary, 77 West Wacker Drive, Suite 4600, Chicago, Illinois 60601, and received by us by April 19, 2018. We will also have personnel in the lobby of the James R. Randall Research Center beginning at 7:30 A.M. on the day of the meeting to consider special requests.

If you properly execute the enclosed proxy form, your shares will be voted at the meeting. You may revoke your proxy form at any time prior to voting by:

(1) delivering written notice of revocation to our Secretary;

(2) delivering to our Secretary a new proxy form bearing a date later than your previous proxy; or

(3) attending the meeting and voting in person (attendance at the meeting will not, by itself, revoke a proxy).

| 6 | ADM Proxy Statement |

| GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTING — Commonly Asked Questions and Answers about the Annual Meeting |

GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

What are the voting requirements for the various proposals?

Under our bylaws, stockholders elect our directors by a majority vote in an uncontested election (one in which the number of nominees is the same as the number of directors to be elected) and by a plurality vote in a contested election (one in which the number of nominees exceeds the number of directors to be elected). Because this year’s election is an uncontested election, each director nominee receiving a majority of votes cast will be elected (the(where the number of shares voted “for” a director nominee must exceedexceeds the number of shares voted “against” that nominee). will be elected. Approval of each other proposal presented in the proxy statement requires the affirmative vote of the holders of a majority of the outstanding shares of common stock present, in person or by proxy, at the meeting and entitled to vote on that matter. Shares not present at

What are the meetingeffects of abstentions and shares votingbroker non-votes on voting?

A vote to “abstain” on the election of directors will have no effect on the electionoutcome of directors. Forthat proposal. A vote to “abstain” on each other proposal presented in this proxy statement will have the effect of a vote against those proposals.

If you hold shares in street name, your broker, bank, or other nominee is required to vote your shares according to your instructions. If you do not give instructions to your broker, bank, or other nominee, it will still be able to vote your shares with respect to certain “discretionary” items, but will not be allowed to vote your shares with respect to “non-discretionary” items. Proposals 1, 2, and 4 are “non-discretionary” items. If you do not instruct your broker, bank, or other nominee how to vote with respect to those proposals, it may not vote for those proposals, and you shares will be counted as broker “non-votes.” Proposal 3 is considered to be voted on at the meeting, abstentions are treated as shares presenta discretionary item, and your broker, bank, or represented and voting, and therefore have the same effect as negative votes. Brokernon-votes (shares held by brokers who do not have discretionary authorityother nominee will be able to vote on the matter and havethis proposal even if it does not received votingreceive instructions from you. Broker non-votes will not have any effect on the result of the vote on any of the proposals.

What are the Company’s costs associated with this proxy solicitation?

We pay the costs of soliciting proxies from our stockholders. We have retained Georgeson LLC to help us solicit proxies. We will pay Georgeson LLC a base shareholder meeting services fee of approximately $15,000 plus reasonable project management fees and expenses for its services. Our employees or employees of Georgeson LLC may also solicit proxies in person or by telephone, mail, or the internet at a cost which we expect will be nominal. We will reimburse brokerage firms and other securities custodians for their clients)reasonable fees and expenses in forwarding proxy materials to their principals.

Who can attend the Annual Meeting?

Our stockholders and advisors to our Company are counted towardthe only people entitled to attend the annual meeting.

Why is the Annual Meeting being held virtually?

The annual meeting this year will be a quorum, but are not countedcompletely virtual meeting of stockholders, held at www.virtualshareholdermeeting.com/ADM2024. Hosting a virtual meeting provides expanded access, improved communication, and cost savings for our stockholders and us and enables participation from any purposelocation around the world.

How can stockholders submit questions to management during the Annual Meeting?

Stockholders may submit questions during the annual meeting at www.virtualshareholdermeeting.com/ADM2024, and subject to the meeting rules of conduct, management will respond to questions following adjournment of the formal business of the annual meeting and after any management remarks. If you have questions during the meeting, you may type them in determining whether a matter has been approved.

PRINCIPAL HOLDERS OF VOTING SECURITIES

Based upon filings with the Securities and Exchange Commission (“SEC”), we know thatdialog box at any point during the following stockholders are beneficial owners of more than 5% of our outstanding common stock shares:meeting until the floor is closed to questions.

| ||||

| ||||

| ||||

|

(1) Based

PROPOSAL NO. 1

Proposal No. 1 — Election of Directors for a One-Year Term

The Board of Directors currently consists of eleven members. The Board, acting on a Schedule 13G filed with the SEC on February 8, 2018, State Farm Mutual Automobile Insurance Companyrecommendation of the Nominating and related entities have sole voting and dispositive power with respect to 56,294,742 shares and shared voting and dispositive power with respect to 275,219 shares.

(2) Based on a Schedule 13G/A filed withCorporate Governance Committee, has nominated each of the SEC on February 12, 2018, The Vanguard Group has sole voting power with respect to 791,706 shares, sole dispositive power with respect to 43,910,516 shares, shared voting power with respect to 132,079 shares, and shared dispositive power with respect to 898,408 shares.

(3) Based on a Schedule 13G/A filed withcurrent directors for re-election at the SEC on February 8, 2018, BlackRock, Inc. has sole voting power with respect to34,400,114 shares and sole dispositive power with respect to 41,953,714 shares.

(4) Based on a Schedule 13G filed with the SEC on February 13, 2018, State Street Corporation has shared voting and dispositive power with respect to 32,600,161 shares.annual meeting.

Proxies cannot be voted for a greater number of persons than eleven, which is the number of nominees. |

| • | Unless you provide different directions, we intend for Board-solicited proxies (like this one) to be voted for the nominees named below. |

| • | If any nominee for director becomes unable to serve as a director, the persons named as proxies may vote for a substitute who will be designated by the Board. Alternatively, the Board could reduce the size of the board. |

PROPOSAL NO. 1 — ELECTION OF DIRECTORS FOR A ONE-YEAR TERM

Our Board of Directors has fixed the size of the current board at twelve. Eleven of the twelve nominees proposed for election to our Board of Directors are currently members of our Board and have been elected previously by our stockholders. The new nominee for election is Michael S. Burke. Mr. Burke was identified by the Nominating/Corporate Governance Committee as a potential nominee, with assistance from athird-party search firm retained to identify director candidates, and was recommended by the Nominating/Corporate Governance Committee after it completed its interview and vetting process. Unless you provide different directions, we intend for board-solicited proxies (like this one) to be voted for the nominees named below.

If elected, the nominees would hold office until the next annual stockholders’ meeting and until their successors are elected and qualified. If any nominee for director becomes unable to serve as a director, the persons named as proxies may vote for a substitute who will be designated by the Board of Directors. Alternatively, the Board of Directors could reduce the size of the board. The Board has no reason to believe that any nominee will be unable to serve as a director.

Our bylaws require that each director be elected by a majority of votes cast with respect to that director in an uncontested election (where the number of nominees is the same as the number of directors to be elected). In a contested election (where the number of nominees exceeds the number of directors to be elected), the plurality voting standard governs the election of directors. Under the plurality standard, the number of nominees equal to the number of directors to be elected who receive more votes than the other nominees are elected to the Board, regardless of whether they receive a majority of the votes cast. Whether an election is contested or not is determined as of the day before we first mail our meeting notice to stockholders.

| • | This year’s election was determined to be an uncontested election, and the majority vote standard will apply. For more details on the voting standard, see above under “Commonly Asked Questions and Answers about the Annual Meeting.” |

| • | If elected, the nominees would hold office until the next annual stockholders’ meeting and until their successors are elected and qualified. |

If a nominee who is serving as a director is not elected at the annual meeting, Delaware law provides that the director would continue to serve on the Board as a “holdover director.” However, under our Corporate Governance Guidelines, each director annually submits an advance, contingent, irrevocable resignation that the Board may accept if the director fails to be elected through a majority vote in an uncontested election. In that situation, the Nominating/Nominating and Corporate Governance Committee would make a recommendation to the Board about whether to accept or reject the resignation. The Board will act on the Nominating/Nominating and Corporate Governance Committee’s recommendation and publicly disclose its decision and the rationale behind it within 90 days after the date that the election results are certified. The Board will nominate for election orre-election as director, and will elect as directors to fill vacancies and new directorships, only candidates who agree to tender the form of resignation described above. If a nominee who was not already serving as a director fails to receive a majority of votes cast at the annual meeting, Delaware law provides that the nominee does not serve on the Board as a “holdover director.”

The information below describes, as applicable, the nominees, their ages, positions with our company,Company, principal occupations, current directorships of other publicly owned companies, directorships of other publicly owned companies held within the past five years, the year in which each first was elected as a director, and the number of shares of common stock beneficially owned as of March 12, 2018,April 4, 2024, directly or indirectly. Unless otherwise indicated, and subject to community property laws where applicable, we believe that each nominee named in the table below has sole voting and investment power with respect to the shares indicated as beneficially owned. Unless otherwise indicated, all of the nominees have been executive officers of their respective companies or employed as otherwise specified below for at least the last five years.

The Board of Directors recommends a vote FOR the election of the twelve nominees named below as directors. Proxies solicited by the Boardhas no reason to believe that any nominee will be so voted unless stockholders specifyunable to serve as a different choice.director.

| The Board of Directors recommends a vote FOR the election of the eleven nominees named below as directors. Proxies solicited by the Board will be so voted unless stockholders specify a different choice. | |||||||

| 8 | ADM Proxy Statement |

| PROPOSAL NO. 1 — Election of Directors for a One-Year Term |

PROPOSAL NO. 1 —ELECTION OF DIRECTORS

Director Nominees

Michael S. Burke Age: 61 Director since: 2018 Board Committees: Audit (Chair); Executive; Nominating and Corporate Governance Common stock owned: 20,032 (1) Percent of class: * Qualifications, Skills, and Experience CEO Leadership Finance / Accounting International Business M&A Risk Management Sustainability / Environmental / Social Project Management | Mr. Burke brings deep expertise in driving the evolution of global businesses, strategic planning, international market dynamics, and overseeing risk management from his tenure as Chair and CEO of AECOM, a Fortune 500 company that designs, builds, finances and operates infrastructure assets in more than 150 countries. He also contributes his significant experience leading companies through transformation, developed through his roles at AECOM, where he played a key role in preparing the company for its IPO in 2007, and spearheaded international business development and M&A strategy. At AECOM, Mr. Burke also transformed one of the firm’s subsidiaries into a leading environmental engineering firm, developing significant sustainability expertise, which he has further developed through serving on the boards of CarbonCure and Nexii Building Solutions, companies focused on reducing harmful emissions in the construction process. He also brings expertise in finance, accounting, and tax matters drawing on his experience as a Chief Financial Officer and his 15-year career at KPMG advising public companies. | |||

• PRIOR (within past 5 years): AECOM (Chairman) Non-Public & Non-Profit Boards; Memberships • CURRENT: Universal Engineering Sciences (Chair); Westwood Professional Services (board member); SitelogIQ (board member); CarbonCure (board member); Nexii Building Solutions (board member); American Institute of Certified Public Accountants (member); California Bar Association (member) • PRIOR: Business Roundtable (board member; Chair, Infrastructure Committee); Children’s Bureau (Vice Chair); World Economic Forum (Co-Chair, Steering Committee, Infrastructure and Urban Development) | Career Highlights • AECOM (a global infrastructure firm) - Chairman and Chief Executive Officer (2015-2020) - Chief Executive Officer (2014-2015) - President (2011-2014) - Other leadership roles (2005-2011), including Chief Financial Officer (2006-2011) • KPMG LLP - Member of Board of Directors (2000-2005) - Partner (1995-2005) - Various roles (1990-1995) | |||

Age: 69

| ADM Proxy Statement 2024 | 9 |

| PROPOSAL NO. 1 — Election of Directors for a One-Year Term |

Director since: 2012

Common stock owned:37,571(1)

Theodore Colbert Age: 50 Director since: 2021 Board Committees: Audit; Compensation and Succession Common stock owned: 9,395 (2) Percent of class: * Qualifications, Skills, and Experience International Business M&A Risk Management Sales / Marketing Project Management Information Technology / Cybersecurity | Mr. Colbert brings extensive corporate leadership experience to the Board, along with his deep expertise in information technology, cybersecurity, data and analytics, and automation, which he acquired over his nearly three-decade career overseeing information technology, data security and architecture at several global market-leading companies. His most recent positions at Boeing further developed his sales and marketing capabilities, M&A experience, government regulation experience, and expertise in international business dynamics, including his role as President and CEO of its Global Services business that provided services to global customers across all OEMs and his current role as President and CEO of Boeing Defense, Space & Security, providing solutions across defense, government, space, intelligence, and security to customers worldwide. Leading global businesses focused on serving security and national defense companies distinguishes Mr. Colbert as an expert in world-class information security systems and risk management. This expertise has been honored with numerous prestigious awards throughout his career, including most recently the 2022 Black Engineer of the Year Award and the 2022 ORBIE Award for Leadership, being named the 2021 Capital CIO of the Year and one of the Most Influential Black Executives in Corporate America by Savoy magazine in 2020 and 2021, as well as being the first recipient of the Fisher Center prize for Excellence in Driving Transformation from the Fisher Center For Business Analytics at Berkeley. | |||

Non-Public & Non-Profit Boards; Memberships • CURRENT: The National Space Council Users Advisory Group (appointed by Vice President Kamala Harris); New Leaders (Chair); The Executive Leadership Council (member); Thurgood Marshall College Fund (Co-Vice Chair); DC College Access Program (board member); Virginia Tech Innovation Campus Advisory Board (board member); Aerospace Industries Association (Chair) • PRIOR: Georgia Tech President’s Advisory Board (two terms) | Career Highlights • Boeing (a global aerospace company) - Executive Vice President of The Boeing Company and President and Chief Executive Officer of Boeing Defense, Space & Security (2022-present) - Executive Vice President of The Boeing Company and President and Chief Executive Officer of Boeing Global Services (2019-2022) - Chief Information Officer and Senior Vice President of Information Technology & Data Analytics (2016-2019) - Chief Information Officer and Vice President of Information Technology Infrastructure (2013-2016) - Other leadership roles (2009-2013) • Citigroup - Senior Vice President of Enterprise Architecture (2007-2009) • Ford Motor Company - Various roles in the Information Technology organization (1996-2007) | |||

| 10 | ADM Proxy Statement 2024 |

| PROPOSAL NO. 1 — Election of Directors for a One-Year Term |

Percent of class: *

Former Principal Occupation or Position:Non-Executive Chairman of Fluor Corporation (an engineering and construction firm) from 2011 – February 2012; Chairman and Chief Executive Officer of Fluor Corporation from 2002 – 2011.

James C. Collins, Jr. Age: 61 Director since: 2022 Board Committees: Compensation and Succession; Sustainability and Corporate Responsibility Common stock owned: 4,459 (1) Percent of class: * Qualifications, Skills, and Experience CEO Leadership International Business Agriculture / Food / Retail Consumer M&A Sustainability / Environmental / Social Sales / Marketing Project Management Food Science / R&D | Mr. Collins contributes to the Board deep expertise in global agriculture and food science innovation developed over his extensive executive leadership experience in the food and agriculture industry. During his tenure leading agriculture business lines at DuPont and Dow DuPont, and most recently as the CEO of Corteva – the public spin-off of Dow DuPont’s crop protection and agrisciences divisions with a global scale – he oversaw the launch of numerous new products and drove strong growth in their R&D and innovation pipelines. His experience leading the integration of legacy DuPont and Dow agricultural businesses to drive preparation for Corteva’s spin also enhances the Board’s M&A and corporate governance expertise. He also brings extensive sales and marketing experience, beginning as a sales representative early in his career and later taking on leadership roles with responsibility for implementing multi-channel, multi-brand growth strategies. Through his work in agriculture supply chains, Mr. Collins has also developed a keen understanding of how to support and partner with global farmers to improve the sustainability of the agriculture and nutrition value chains. During his time at Corteva, he led a comprehensive array of initiatives to enhance sustainability, with a strong focus on helping farmers lead with new practices and innovations. He currently serves on the board of Vestaron Corporation, a private company dedicated to improving the safety, efficacy and sustainability of crop protection through migration from synthetic pesticides to peptide-based biopesticides. | |||

Public Boards • PRIOR (within past 5 years): Corteva, Inc.; Cibus, Inc. Non-Public & Non-Profit Boards; Memberships • CURRENT: Vestaron Corporation (board member); Pivot Bio (board member); University of Delaware College of Agriculture and Natural Resources (Advisory Committee member) • PRIOR: CropLife International (board member); University of Delaware’s Alfred Lerner College of Business & Economics (advisory board member); US China Business Council (member); Business Roundtable (Special Committee on Equity and Racial Justice; Climate Policy Committee; Trade Committee); National 4-H Council (board member) | Career Highlights • Corteva, Inc. (a global agricultural and seed company) - Chief Executive Officer (2019-2021) • DowDuPont - Chief Operating Officer (2017-2019) • DuPont - Executive Vice President (2014-2017) - Senior Vice President (2013-2014) - President Industrial Biosciences (2011-2013) - VP Acquisitions and Integration – Danisco (2011) - President Crop Protection (2003-2010) | |||

| ADM Proxy Statement 2024 | 11 |

| PROPOSAL NO. 1 — Election of Directors for a One-Year Term |

Directorships of Other Publicly-Owned Companies: Director of Sempra Energy and BP p.l.c.

Terrell K. Crews Lead Director Age: 68 Director since: 2011 Board Committees: Executive Common stock owned: 54,355 (3) Percent of class: * Qualifications, Skills, and Experience Finance / Accounting International Business Agriculture / Food / Retail Consumer M&A Risk Management Sustainability / Environmental / Social | Mr. Crews, who has served as our independent Lead Director since May 2023, contributes to the Board deep expertise in the international agricultural industry, business transformation, and agri-business operations gained over his 32-year career at Monsanto, a global agrochemical and agricultural biotechnology company. Serving in his role as Chief Financial Officer at Monsanto for nearly a decade, Mr. Crews oversaw corporate finance and reporting in addition to capital allocation strategies. His other roles with the company included helming the global vegetable business, assignments in Latin America, and leading financial operations for its Asia-Pacific business, which gave him significant expertise in risk management and strategic planning. Mr. Crews also has experience leading financing for M&A activity and other corporate transactions, including overseeing the financial integration of 11 acquired seed companies as head of finance for Monsanto’s Global Seed Group. His long tenure in agricultural industry executive leadership led him to develop a keen understanding of evolving views of broad stakeholder groups on sustainability and contributed to his experience developing capital allocation strategies aligned with corporate sustainability priorities. Recognized by the NACD Directorship 100™for his leadership, excellence, and integrity in corporate governance, Mr. Crews is well-qualified to serve in the role of Lead Director. Additionally, having served on the Board since 2011, his tenure enables him to have a deep understanding of the Company’s strategy, business, products, and goals, allowing him to more effectively provide independent strategic leadership to the Company. | |||

Public Boards • CURRENT: WestRock Company • PRIOR (within past 5 years): Hormel Foods Corporation Non-Public & Non-Profit Boards; Memberships • CURRENT: Freed-Hardeman University (board member); Teay’s River Investments (board member) | Career Highlights • Monsanto Company (a global agricultural and seed company) - Executive Vice President, Chief Financial Officer and Vegetable Business CEO (2007-2009) - Executive Vice President and Chief Financial Officer (2000-2007) - Various other roles (1977-2000) | |||

| 12 | ADM Proxy Statement 2024 |

| PROPOSAL NO. 1 — Election of Directors for a One-Year Term |

Ellen de Brabander Age: 61 Director since: 2023 Board Committees: Audit; Sustainability and Corporate Responsibility Common stock owned: 2,599 (1) Percent of class: * Qualifications, Skills, and Experience International Business Agriculture / Food / Retail Consumer M&A Risk Management Sustainability / Environmental / Social Project Management Food Science / R&D Information Technology / Cybersecurity | Dr. de Brabander brings to the Board a broad scientific background and a strong track record of innovation in several consumer industries including human nutrition, life sciences and animal health. In her current role as Executive Vice President of Innovation and Regulatory Affairs at Elanco, Dr. de Brabander utilizes her R&D expertise driving early and late-stage pipeline execution across pet health and farm animals, including nutritional health solutions. This deep research and innovation expertise was fostered in her previous role as senior vice president for R&D at PepsiCo, with company-wide responsibility for food safety, quality, regulatory and digital transformation. She also led R&D operations for global businesses, including Merial (now Boehringer Ingelheim), Intervet (now Merck Animal Health) and DSM, and brings extensive experience with information technology, having served as the Chief Technology Officer for Merial. In addition to her corporate success, she has been a founding board member of EIT (European Institute of Technology) and founding CEO of EIT Food, the largest public-private partnership in the food sector. Dr. de Brabander earned her Ph.D. cum laude in bio-organic chemistry from Leiden University in the Netherlands and completed her post-doctoral work in molecular biology at the Massachusetts Institute of Technology (MIT) in the group of Prof. Dr. H.G. Khorana, a Nobel laureate. She is the co-author of over 60 publications in scientific journals, holds 18 patents, and has received multiple awards for her research. | |||

Non-Public & Non-Profit Boards; Memberships • CURRENT: PeakBridge (scientific advisory board member and investment committee member); Brabantse Ontwikkel Maatschappij (a regional development organization in The Netherlands) (board member); Sanquin Health Solutions (board member); Brightlands Venlo (food/ agro innovation campus and ecosystem in The Netherlands) (board president) • PRIOR: New York Academy of Sciences (board member); Open University, The Netherlands (board member) | Career Highlights • Elanco (a global leader in animal health) - Executive Vice President, Innovation and Regulatory Affairs (2021-present) • PepsiCo - Senior Vice President, R&D Technical Insights, Digital Solutions, and Compliance (2014-2021) • EIT Food (food innovation community supported by the EU) - Interim Chief Executive Officer (2016-2018) • Merial (now part of Boehringer Ingelheim Animal Health) - Chief Technology Officer (2008-2014) | |||

| ADM Proxy Statement 2024 | 13 |

| PROPOSAL NO. 1 — Election of Directors for a One-Year Term |

Suzan F. Harrison Age: 66 Director since: 2017 Board Committees: Audit;Executive; Sustainability and Corporate Responsibility (Chair) Common stock owned: 20,273 (1) Percent of class: * Qualifications, Skills, and Experience International Business Agriculture / Food / Retail Consumer M&A Sustainability / Environmental / Social Sales / Marketing Food Science / R&D | In her four decades of executive leadership positions at Colgate-Palmolive, a global consumer products company focused on the production, distribution and provision of household, healthcare and personal care, Ms. Harrison has gained extensive experience in operational management and M&A. She acquired deep understanding of evolving consumer trends, sales and marketing and development of customer-driven innovation as Vice President of Marketing for Colgate U.S. She also built her research and development experience overseeing the new products development process for retail customers in oral care, pet nutrition and oral pharmaceuticals. Ms. Harrison has extensive sustainability experience acquired through her oversight of global brands and their evolution in alignment with stakeholder sustainability expectations. Ms. Harrison has been recognized by the NACD Directorship 100™for her leadership, excellence, and integrity in corporate governance. | |||

Public Boards • CURRENT: WestRock Company; Ashland Inc. | Career Highlights • Colgate-Palmolive Company (a global household and consumer products company) - President of Global Oral Care (2011-2019) - President Hill’s Pet Nutrition Inc. North America (2009-2011) - Vice President, Marketing (2006-2009) - Vice President and General Manager of Colgate Oral Pharmaceuticals, North America, and Europe (2005-2006) - Various other roles (1983-2005) | |||

| 14 | ADM Proxy Statement 2024 |

| PROPOSAL NO. 1 — Election of Directors for a One-Year Term |

Juan R. Luciano Chair of the Board Age: 62 Director since: 2014 Board Committees: Executive Common stock owned: 2,398,947 (4) Percent of class: * Qualifications, Skills, and Experience CEO Leadership International Business Agriculture / Food / Retail Consumer M&A Risk Management Sustainability / Environmental / Social Sales / Marketing Project Management Food Science / R&D | Since joining ADM in 2011, Mr. Luciano has spent more than a decade in various senior executive leadership roles working to drive our Company’s evolution. During his time with ADM he has spearheaded our major growth drivers and sales and marketing efforts, including the commercial and production activities of ADM’s corn, oilseeds, and agricultural services businesses, development of sustainability strategy, and the increased use of research and technological innovation to meet customer needs. He most recently led a strategic growth campaign that has expanded ADM’s footprint in global markets, including through select M&A activity, building capabilities and adding talent and expertise that have allowed our Company to create value at every part of the global value chain. Under his leadership, ADM has undergone a remarkable transformation, building on more than a century of heritage to create a global nutrition business, with an industry-leading array of ingredients and solutions that are opening the door to growth opportunities in key global macro trend areas. He also has overseen the Company’s operational excellence initiatives and risk management functions. Prior to joining ADM, he had a successful 25-year tenure at The Dow Chemical Company, where he last served as executive vice president and president of the Performance division. | |||

Public Boards • CURRENT: Eli Lilly and Company (Lead Director). Non-Public & Non-Profit Boards; Memberships • CURRENT: Rush University Medical Center (Director); Intersect Illinois (board member); Economic Club of Chicago (member); Commercial Club of Chicago (member); The Business Roundtable (member) • PRIOR: Kellogg School of Management, Northwestern University (board member); US-China Business Council (member) | Career Highlights • ADM - Chair of the Board, Chief Executive Officer and President (2016-present) - Chief Executive Officer and President (2015-2016) - President and Chief Operating Officer (2014) - Executive Vice President and Chief Operating Officer (2011-2014) • The Dow Chemical Company (a multinational chemical company) - Executive Vice President and President, Performance Division (2010-2011) - Various other roles (1985-2010) | |||

| ADM Proxy Statement 2024 | 15 |

| PROPOSAL NO. 1 — Election of Directors for a One-Year Term |

Patrick J. Moore Age: 69 Director since: 2003 Board Committees: Audit; Executive; Nominating and Corporate Governance (Chair) Common stock owned: 85,791 (1) Percent of class: * Qualifications, Skills, and Experience CEO Leadership Finance / Accounting International Business M&A Risk Management Sustainability / Environmental / Social Project Management | With over two decades of experience in the financial sector, including in his early career at Continental Bank, as CFO at Smurfit-Stone and in his current position as founder, President and CEO of a private equity investment and advisory firm, Mr. Moore contributes to the Board his financial expertise and substantial executive leadership experience in international banking and finance, strategy development, commodity management, and operations management. Throughout his carrier, Mr. Moore developed significant experience in risk management and M&A. Mr. Moore also brings extensive experience in environmental and sustainable practices from his time at Smurfit-Stone, a producer of containerboard and corrugated packaging and one of the world’s largest paper recyclers, and his service on the board of the Sustainable Forestry Initiative, with particular focus on recycling, carbon sequestration, reduction of energy and water usage, and sustainable forestry. Mr. Moore has been recognized by the NACD Directorship 100™for his leadership, excellence, and integrity in corporate governance. | |||

Public Boards • CURRENT: Energizer Holdings, Inc. (Chairman) Non-Public & Non-Profit Boards; Memberships • CURRENT: St. Louis Zoological Association (board member); Hoverfly Holdings (board member); Engineered Corrosion Solutions (board member) • PRIOR: North American Review Board of American Air Liquide Holdings, Inc. | Career Highlights • PJM Advisors, LLC (a private equity investment and advisory firm founded by Mr. Moore) - President and Chief Executive Officer (2011-present) • Smurfit-Stone Container Corporation (a leader in integrated containerboard and corrugated package products and paper recycling) (5) - Chairman and Chief Executive Officer (2002-2011) - Other roles including Chief Financial Officer, Vice President-Treasurer and General Manager, Industrial Packaging division (1987-2002) • Continental Bank - Various roles in corporate lending, international banking, and administration (1975-1987) | |||

| 16 | ADM Proxy Statement 2024 |

| PROPOSAL NO. 1 — Election of Directors for a One-Year Term |

Debra A. Sandler Age: 64 Director since: 2016 Board Committees: Audit; Nominating and Corporate Governance Common stock owned: 22,781 (1) Percent of class: * Qualifications, Skills, and Experience Agriculture / Food / Retail Consumer Sustainability / Environmental / Social Sales / Marketing Food Science / R&D | Ms. Sandler contributes to the Board her strong marketing and operating experience, and extensive understanding of consumer behavior within the evolving retail environment (specifically in the food industry), and a proven record of creating, building, enhancing, and leading well-known consumer brands through her leadership positions at Mars, Johnson & Johnson, and PepsiCo. She developed these skills as a founder, President and Chief Executive Officer of La Grenade Group, LLC, a consulting firm that advises a wide range of clients on marketing innovation and overall business development. She also enhances the Board’s expertise in financial and strategic planning, research and development in the food science industry acquired in her current role as founder and CEO of Mavis Foods. The Board also benefits from Ms. Sandler’s expertise in corporate social responsibility, as demonstrated through her public speaking engagements on topics such as diversity and inclusion, multicultural business development, and health and wellbeing in the consumer packaged goods industry. | |||

Public Boards • CURRENT: Gannett Co., Inc.; Dollar General Corporation; Keurig Dr Pepper Inc. Non-Public & Non-Profit Boards; Memberships • CURRENT: Hofstra University (board member); The Executive Leadership Council (member); Pharmavite, LLC (board member); Trewstar Corporate Board Services (Partner) | Career Highlights • LaGrenade Group, LLC (a marketing consulting firm Ms. Sandler founded to advise consumer packaged goods companies operating in the Health and Wellness space) - President (2015-present) • Mavis Foods, LLC (a startup Ms. Sandler founded that makes and sells Caribbean sauces and marinades) - Chief Executive Officer (2018-present) • Mars, Inc. - Chief Health and Wellbeing Officer (2014-2015) - President, Chocolate, North America (2012-2014) - Chief Consumer Officer of Mars Chocolate North America (2009-2012) • Johnson & Johnson - Various roles, including Worldwide President, McNeil Nutritionals division (1999-2009) • PepsiCo - Various roles, including Marketing Vice President (1985-1999) | |||

| ADM Proxy Statement 2024 | 17 |

Qualifications and Career Highlights:

| PROPOSAL NO. 1 — Election of Directors for a One-Year Term |

Prior

Lei Z. Schlitz Age: 57 Director since: 2019 Board Committees: Compensation and Succession; Sustainability and Corporate Responsibility Common stock owned: 17,135 (1) Percent of class: * Qualifications, Skills, and Experience International Business M&A Sustainability / Environmental / Social Sales / Marketing Project Management Food Science / R&D | Dr. Schlitz is an accomplished leader, with experience in strategy development, M&A and growth initiatives, and operational excellence at an international scale, including several global manufacturing companies. She has extensive expertise in research and development, having served in product development roles at Johnson Controls, Illinois Tool Works (ITW) and Siemens Energy and Automation. She has also built research and development expertise specifically within the food science sector, including during her tenure as executive vice president of ITW’s $22B Food Equipment segment, which services commercial food service and food retail customers around the globe. She also oversaw product portfolio growth by building strong market-driven strategy at Siemens, developing important strategic planning, sales and marketing expertise. Dr. Schlitz contributes to the Board her strong sustainability expertise, including her first-hand experience driving product innovations in energy-efficient electrical distribution products and equipment at GE Global Research and GE Industrial Systems and overseeing diversity and inclusion initiatives at ITW as an executive member of the company’s Diversity & Inclusion Council. Dr. Schlitz holds a doctorate in mechanical engineering from the University of Wisconsin-Milwaukee, and a bachelor’s degree in engineering mechanics from Tsinghua University, China. | |||

Non-Public & Non-Profit Boards; Memberships • CURRENT: Society of Women Engineers (member) | Career Highlights • Johnson Controls (a global building products company) - Vice President and President, Global Products (2022-present) • Illinois Tool Works Inc. (a global multi- industrial manufacturer) - Executive Vice President, Automotive OEM (2020-2022) - Executive Vice President, Food Equipment (2015-2020) - Group President, Worldwide Ware-Wash, Refrigeration, and Weigh/Wrap Businesses (2011-2015) - Vice President, Research & Development, and Head of ITW Technology Center (2008-2011) • Siemens Energy & Automation - Business Manager for Emerging Businesses, Residential Product Division (2006-2008) - Director of Engineering (2001-2006) | |||

| 18 | ADM Proxy Statement 2024 |

| PROPOSAL NO. 1 — Election of Directors for a One-Year Term |

Kelvin R. Westbrook Age: 68 Director since: 2003 Board Committees: Compensation and Succession (Chair); Executive; Nominating and Corporate Governance Common stock owned: 37,283 (1) Percent of class: * Qualifications, Skills, and Experience Agriculture / Food / Retail Consumer M&A Risk Management Information Technology / Cybersecurity | Mr. Westbrook brings valuable insights on consumer trends and preferences, as well as extensive information technology and cybersecurity, acquired through decades serving as President, Chief Executive Officer, and co-founder of two large cable television and broadband companies. As a former partner in the corporate law and mergers and acquisitions practice of a national law firm, he also brings significant legal expertise in M&A and risk management. His risk management and corporate governance expertise developed in this executive role is further enhanced by his service on the boards of directors and board committees of numerous public companies and not-for-profit entities, including experience in regulated industries. Mr. Westbrook has been recognized by the NACD Directorship 100™for his leadership, excellence, and integrity in corporate governance. | |||

Public Boards • CURRENT T-Mobile US, Inc.; Mosaic Company; Camden Property Trust (Lead Independent Trust Manager) Non-Public & Non-Profit Boards; Memberships • CURRENT: Boys and Girls Clubs of Greater St. Louis (board member); BioSTL (board member); University of Washington Foster School of Business (Advisory Board Chair) • PRIOR: BJC Healthcare (board member); St. Louis Internship Program (board member) | Career Highlights • KRW Advisors, LLC (a consulting and advisory firm founded by Mr. Westbrook) - President and Chief Executive Officer (2007-present) • Millennium Digital Media Systems, L.L.C. (a broadband services company) - Chairman and Chief Strategic Officer (2006-2007) - President and Chief Executive Officer (1997-2006) • LEB Communications, Inc. (an affiliate of Charter Communications) - President and Chairman (1993-1996) • Paul Hastings Janofsky & Walker LLP - Partner (1990-1993) | |||

| * | Less than 1% of outstanding shares |

| (1) | Consists of stock units allocated under our Stock Unit Plan that are deemed to be the equivalent of outstanding shares of common stock for valuation purposes. |

| (2) | Includes 9,385 stock units allocated under our Stock Unit Plan. |

| (3) | Includes 53,595 stock units allocated under our Stock Unit Plan. |

| (4) | Includes 1,310,288 shares held in trust, 238 shares held by a family-owned limited liability company, and 905,920 shares that are unissued but are subject to stock options exercisable within 60 days. |

| (5) | Smurfit-Stone Container Corporation and its U.S. and Canadian subsidiaries filed voluntary petitions for reorganization under Chapter 11 of the U.S. Bankruptcy Code in January 2009 and emerged in 2010. |

| ADM Proxy Statement 2024 | 19 |

| PROPOSAL NO. 1 — Election of Directors for a One-Year Term |

DIRECTOR EXPERIENCES, QUALIFICATIONS, ATTRIBUTES, AND SKILLS; BOARD DIVERSITY

Pursuant to retiring in February 2012, Mr. Boeckmann served in a variety of engineering and executive management positions during his35-plus year career with Fluor Corporation, includingnon-executive Chairman of the Board from 2011 to February 2012, Chairman of the Board and Chief Executive Officer from 2002 to 2011, and President and Chief Operating Officer from 2001 to 2002. His tenure with Fluor Corporation included responsibility for global operations and multiple international assignments. Mr. Boeckmann currently serves asour Corporate Governance Guidelines, a director who is a sitting chief executive officer of Sempra Energy and BP p.l.c. Mr. Boeckmann has been an outspoken business leadera company may serve on the boards of no more than two other public companies in promoting international standards for business ethics. His extensive board and executive management experience, coupled with his commitment to ethical conduct in international business activities, makes him a valuable addition to our Board, while all other directors may serve on the boards of Directors.

|

Age: 54

Director since: –

Common stock owned: 0

Percent of class: *

Principal Occupation or Position: Chairman and Chief Executive Officer of AECOM (a global infrastructure firm) since March 2015; Chief Executive Officer of AECOM since March 2014; President of AECOM from 2011 to March 2014.

Directorships of Other Publicly-Owned Companies:Chairman of AECOM; Director of Rentech Inc. and Rentech Nitrogen Fertilizer MLP within the past five years.

Qualifications and Career Highlights: